Coconut

iOS, Android, Web

March 2018 - December 2020

Role - Lead Designer

Coconut on the App Store

Coconut on Google Play

Coconut is a tool to help self-employed people manage their business finances.

I started freelancing in March 2018 when the product had just launched in beta and I joined as a full-time employee in May. During my time there, the product grew from 1000 to over 15000 customers and 500 accountants.

As the only designer my role was across Product, Marketing and Growth and included visual and user experience design, interaction design and prototyping. I created structure around design process, managing and organising the libraries, defined naming conventions and folder structures, and always tried to improve collaboration and workflow between myself, the engineers and the product managers.

I was responsible for all the design output and along with the product team we launched the following features and projects:

Rollout of the iOS Beta to Android, Personal & Business Profiles, New Accounts tab, Ltd Companies, Invoicing, Crowdfunding 2018, Referral, Subscription Billing, Accountant Portal, VAT Management, Scheduled Payments, Open Banking, Pay with PayPal and Onboarding improvements.

Open Banking

Towards the end of 2019 we launched Open Banking, giving customers the ability to connect their other bank accounts and credit cards to Coconut.

Being able to connect external accounts means you can bring all your financial records into one place and make use of Coconut's bookkeeping and tax tools no matter who you bank with.

This is important for self-employed people who already have a business account or a credit card they use for expenses, or for people who still use their personal accounts for business expenses, for example Sole Traders.

We used Truelayer as the Open Banking API provider.

There were a number of design challenges around account setup so that Coconut knows how to categorise your transactions correctly depending if you're a Sole Trader or Limited Company connecting a business or personal account. This is important because the categorisation feeds directly into the tax calculation and VAT suggestions. Another challenge was figuring out how to handle the data we get back from the banks.

I chatted to 11:FS on their Homescreen podcast about some of these challenges along with more general discussions about Open Banking, VAT management, auto categorisation of your spending and designing for the freelance market. You can watch the podcast below.

A suggested rate and a rejected rate with alternative rates and the full list

VAT Management

HMRC’s Making Tax Digital (MTD) programme now requires most VAT-registered business to keep bookkeeping records digitally, and to submit their VAT to HMRC through MTD-compliant software.

The first step for Coconut was to give customers the ability to record VAT on their transactions and to add VAT to invoices.

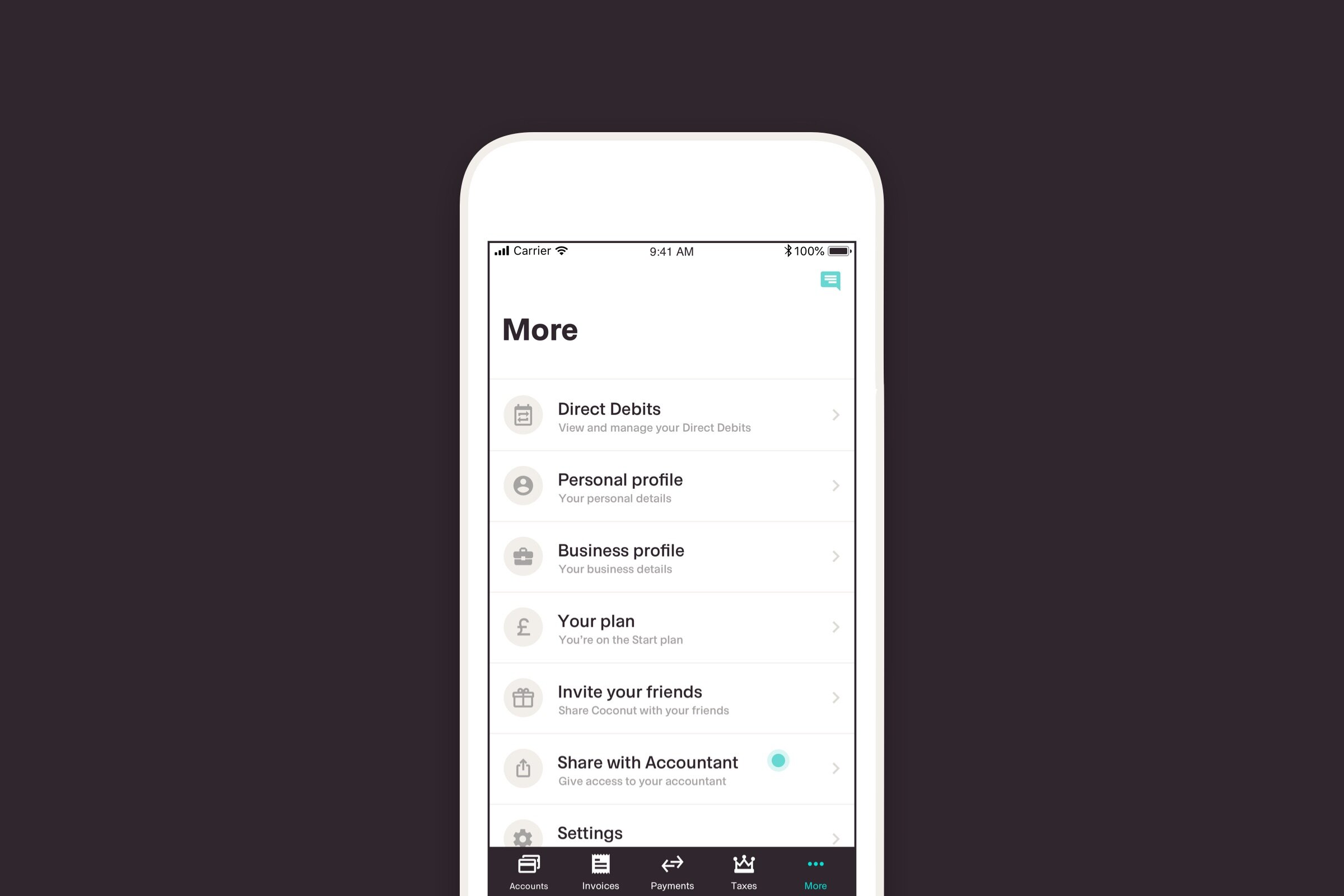

To take advantage of Coconut's VAT feature, you need to enable VAT on your business which you can do on your business profile.

Once you've enabled VAT in the app, all future income and expenses will start recording VAT. Where possible we’ll automatically apply a VAT rate to your transaction and notify you via a push notification.

For example, insurance is exempt of VAT and because we're confident of this we'll automatically apply the exempt VAT rate.

But because VAT rates can vary, where we’re not 100% confident of the rate we’ll suggest one to you based on the category. You can then accept our suggestion or reject it and choose an alternative rate.

Invoicing

In January 2019, we launched an invoicing tool, allowing you to create, send and track your invoices within the Coconut app.

Invoices are automatically marked as paid when the matching payment enters your Coconut account, removing the need to reconcile payments against invoices. If you’re VAT registered, you can add VAT to line items and we'll suggest a VAT rate once the payment has been recieved.

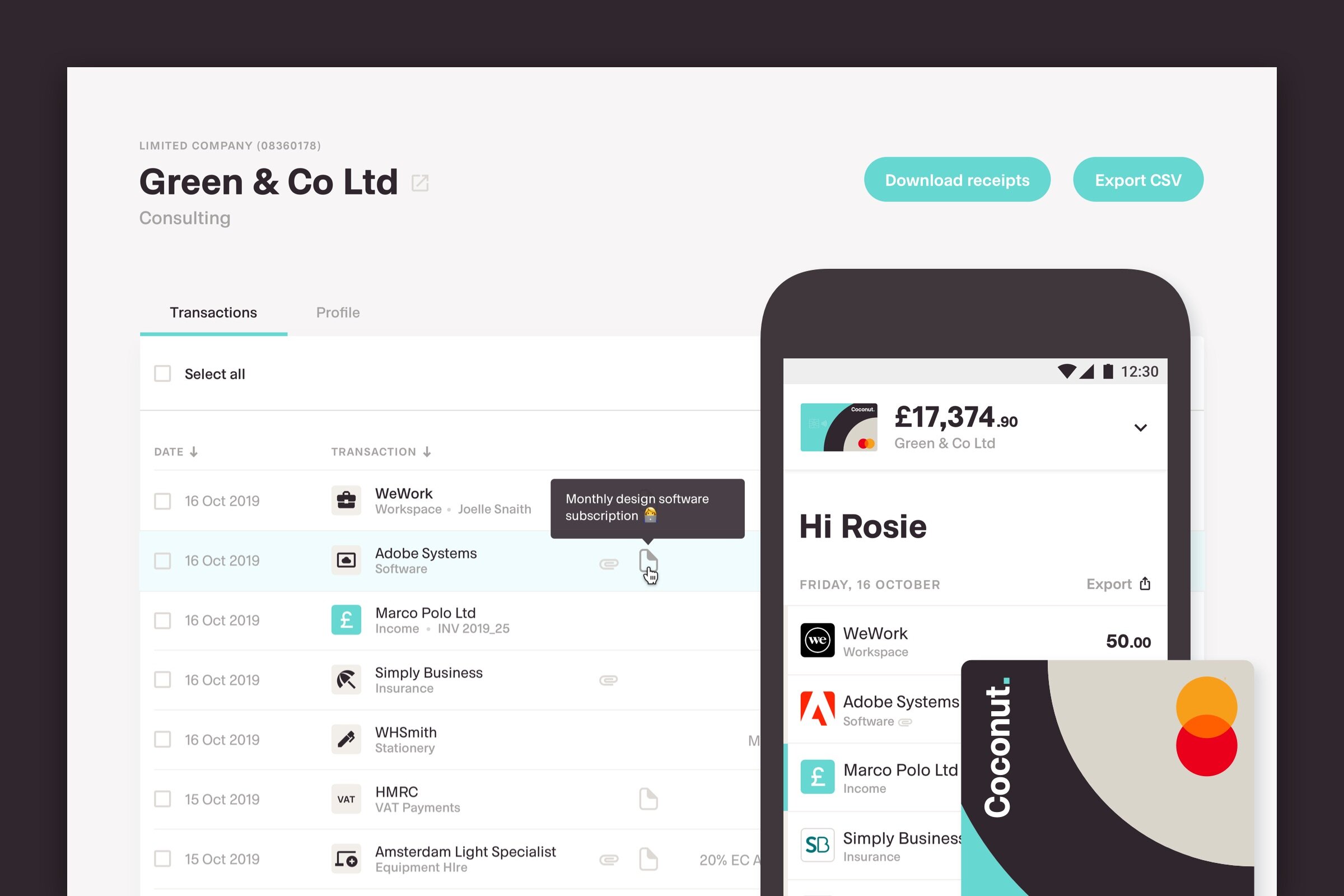

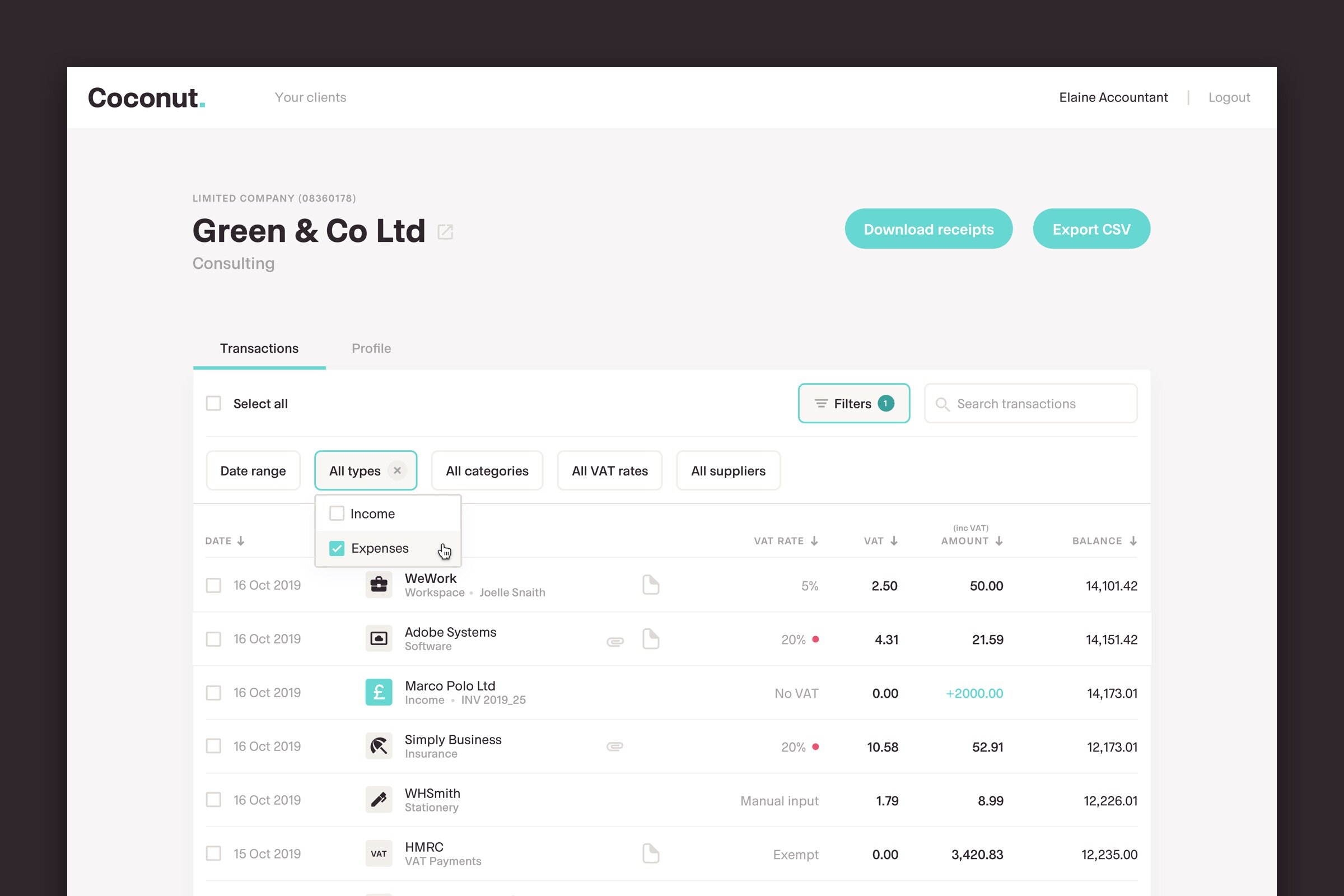

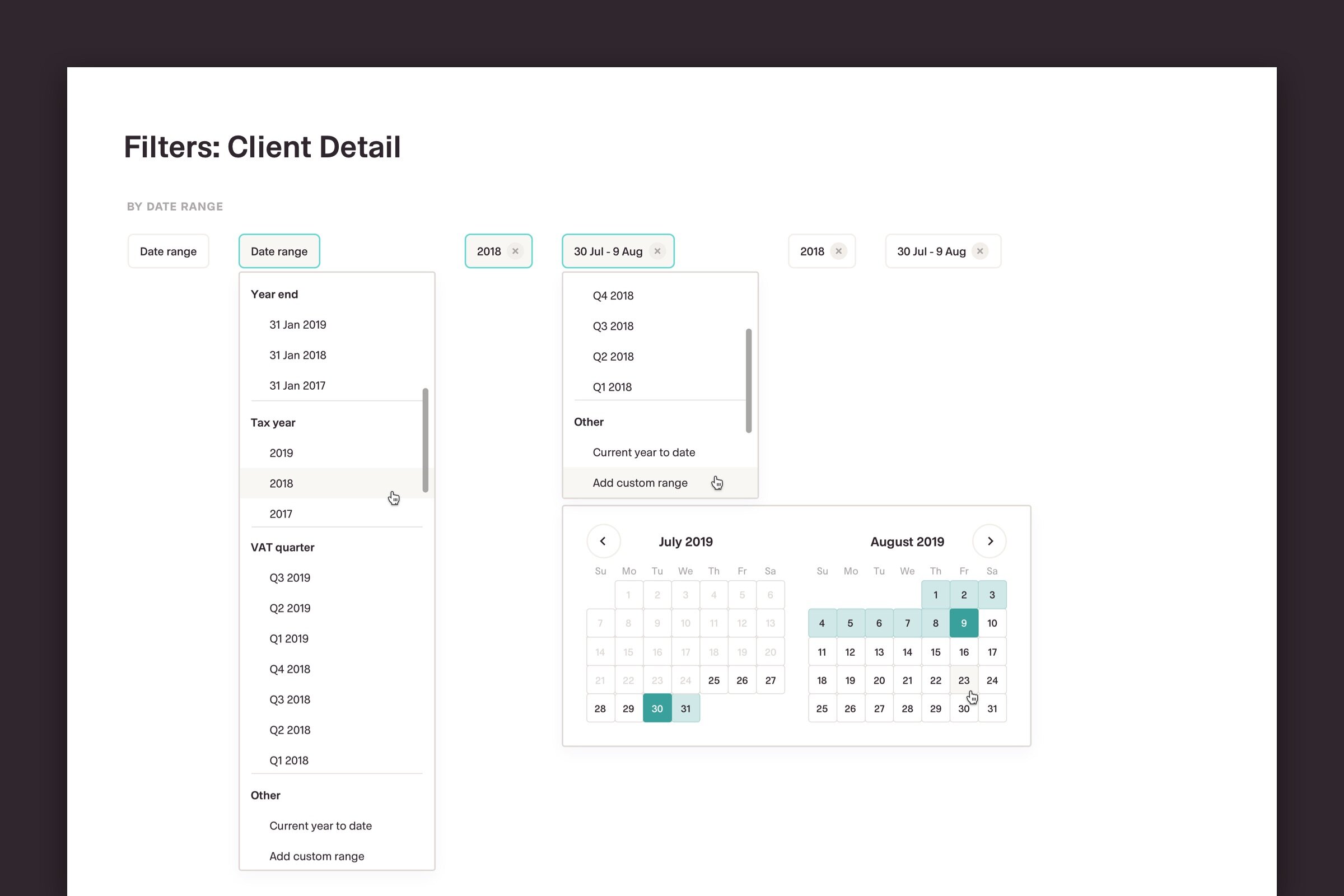

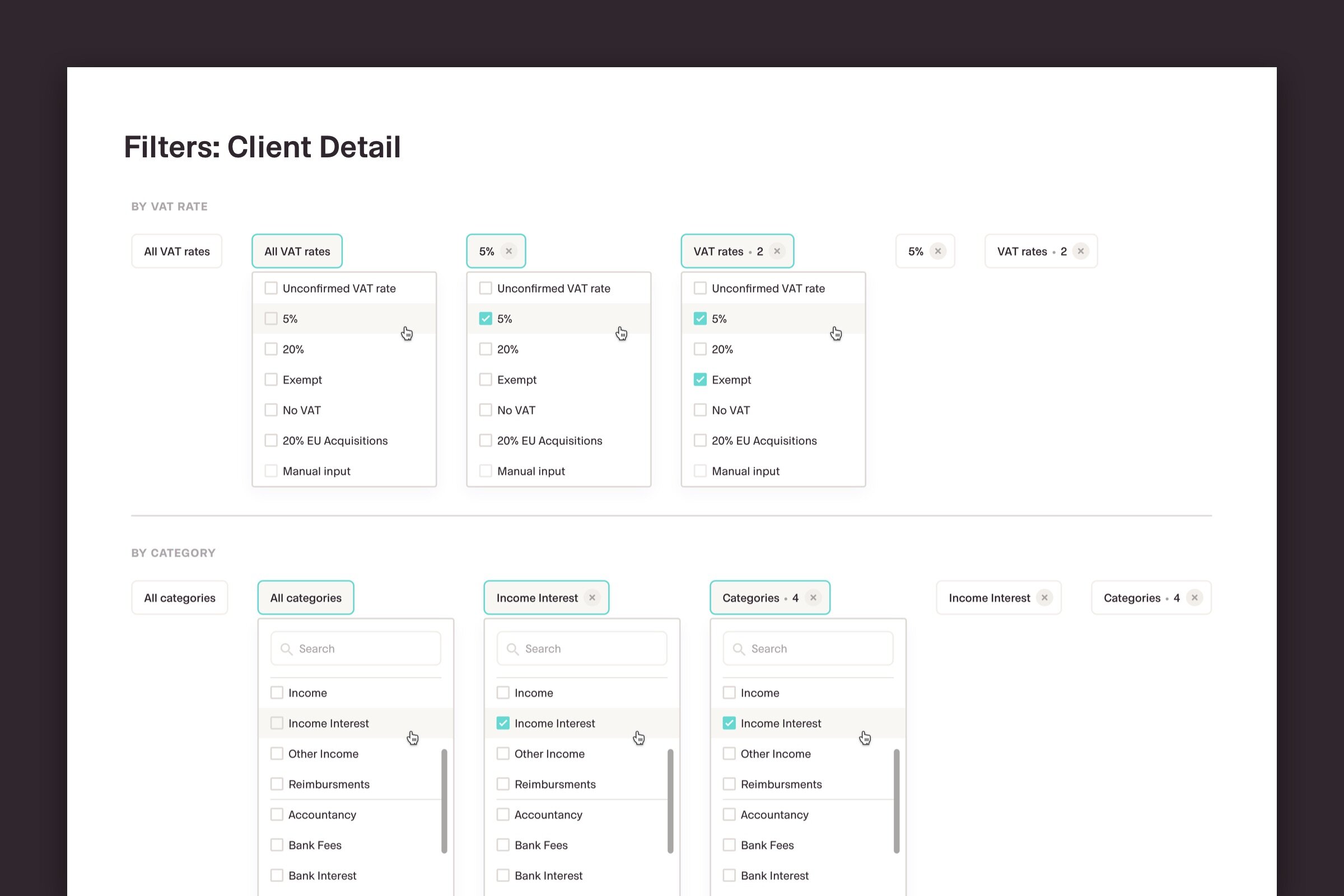

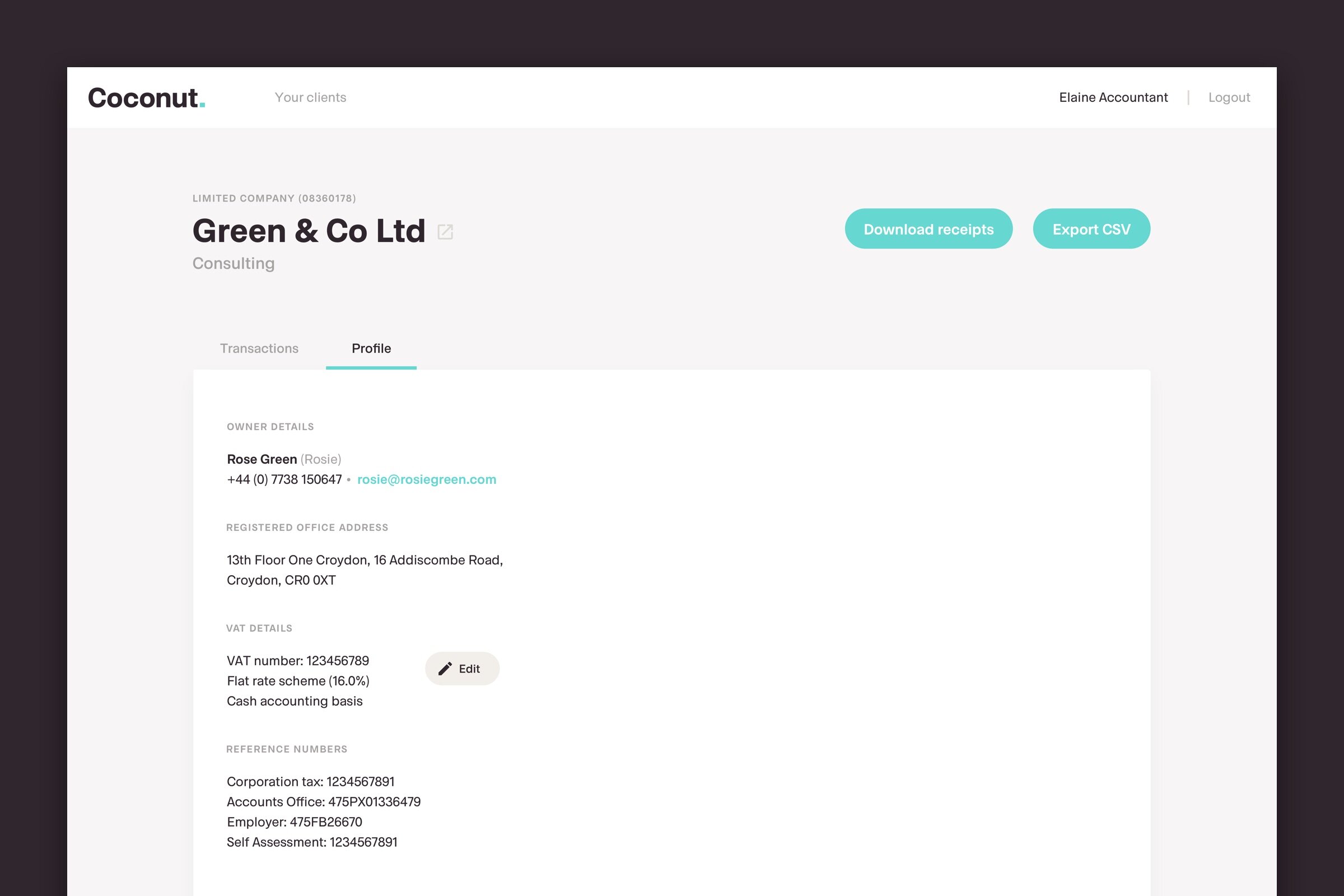

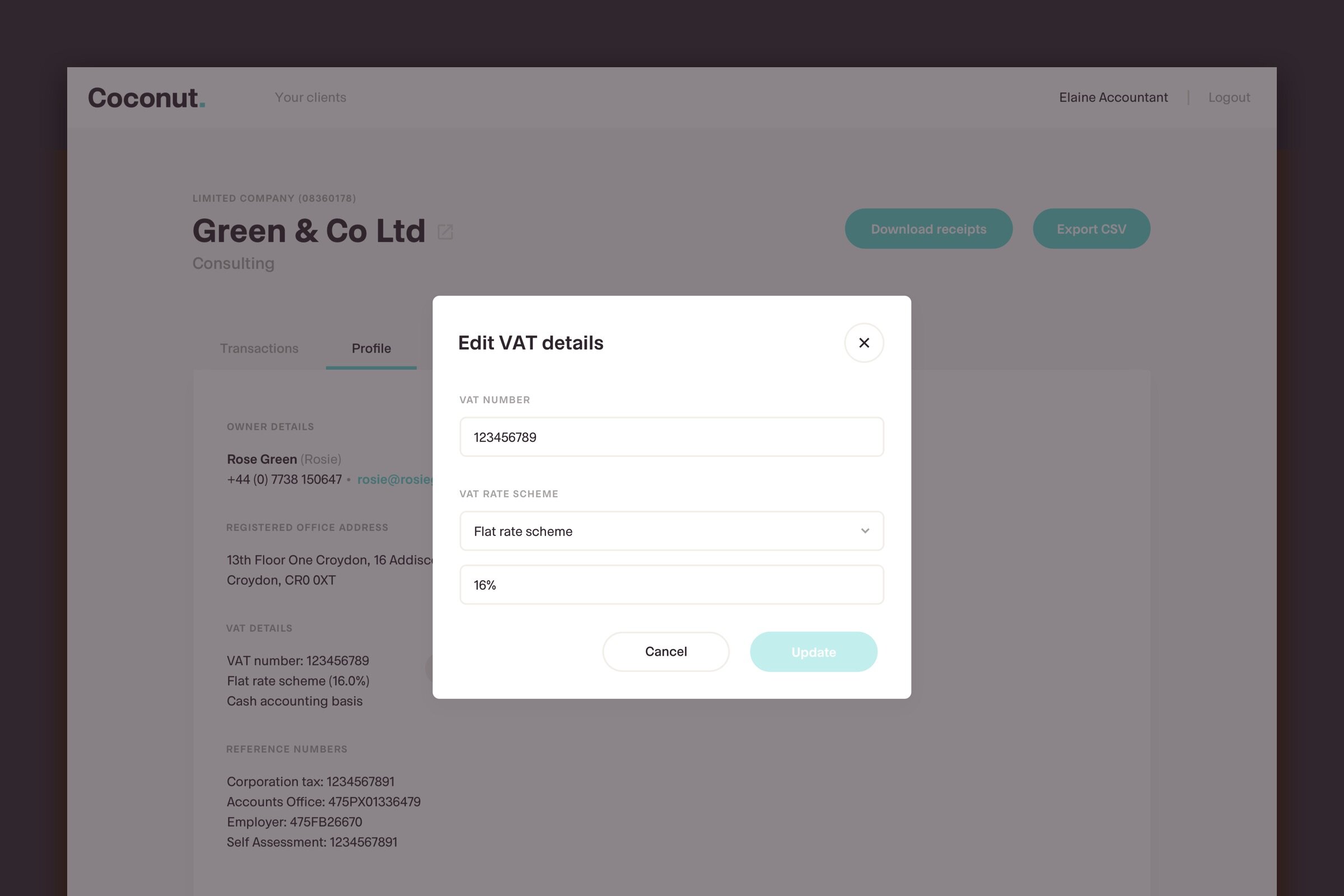

Accountant Portal

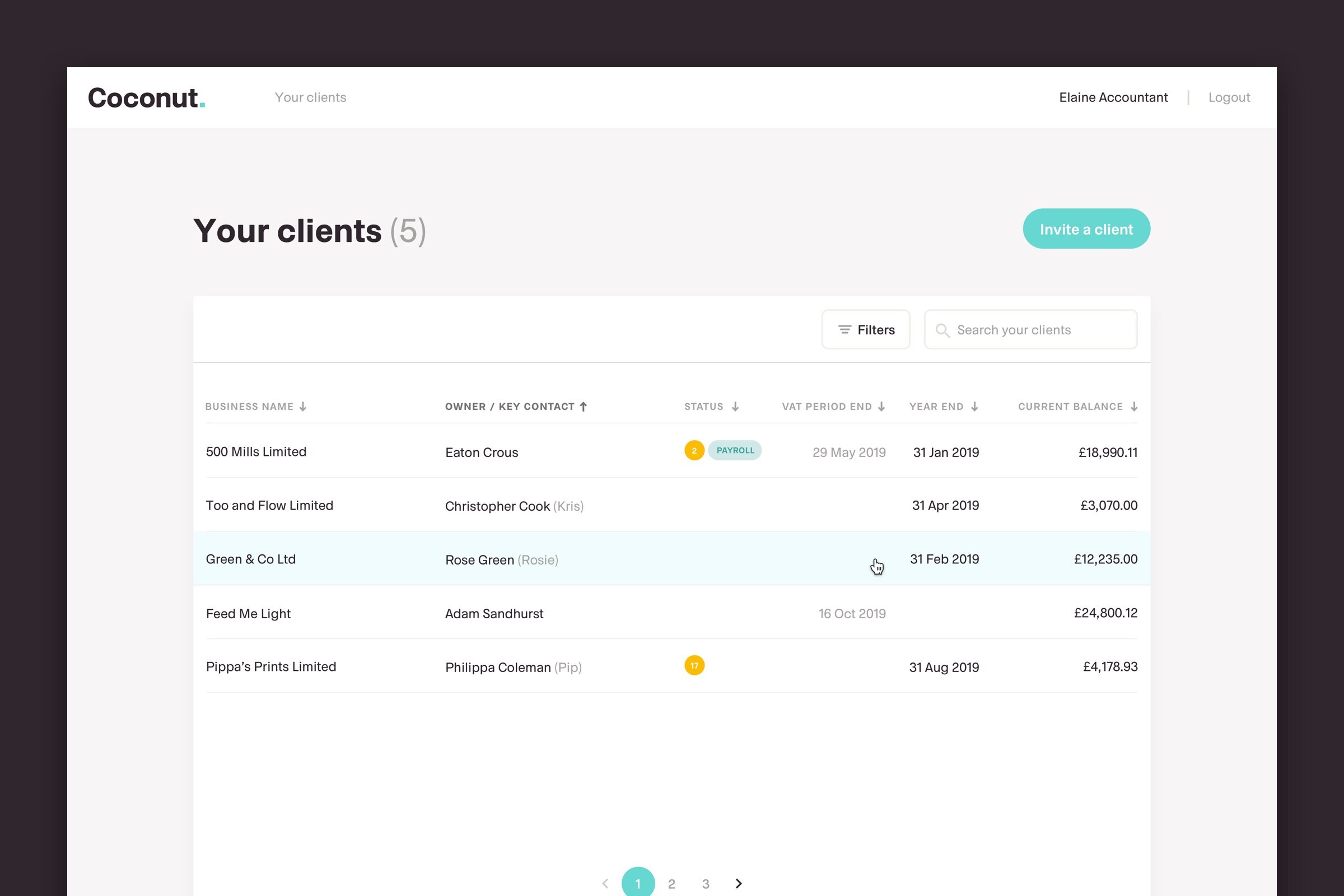

We created the Coconut Accountant Portal to save accountants time by eliminating manual bookkeeping and improving collaboration between accountants and their clients.

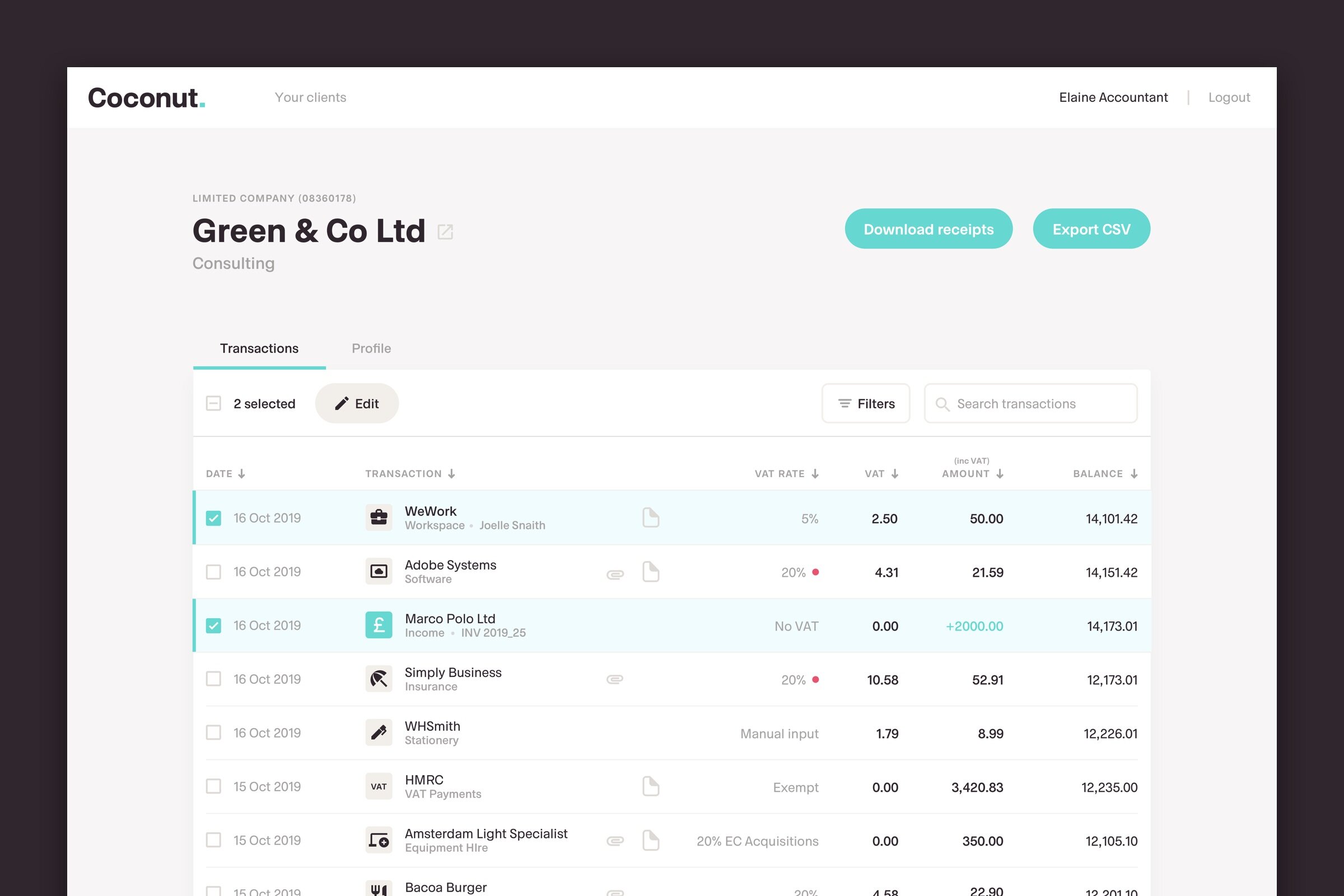

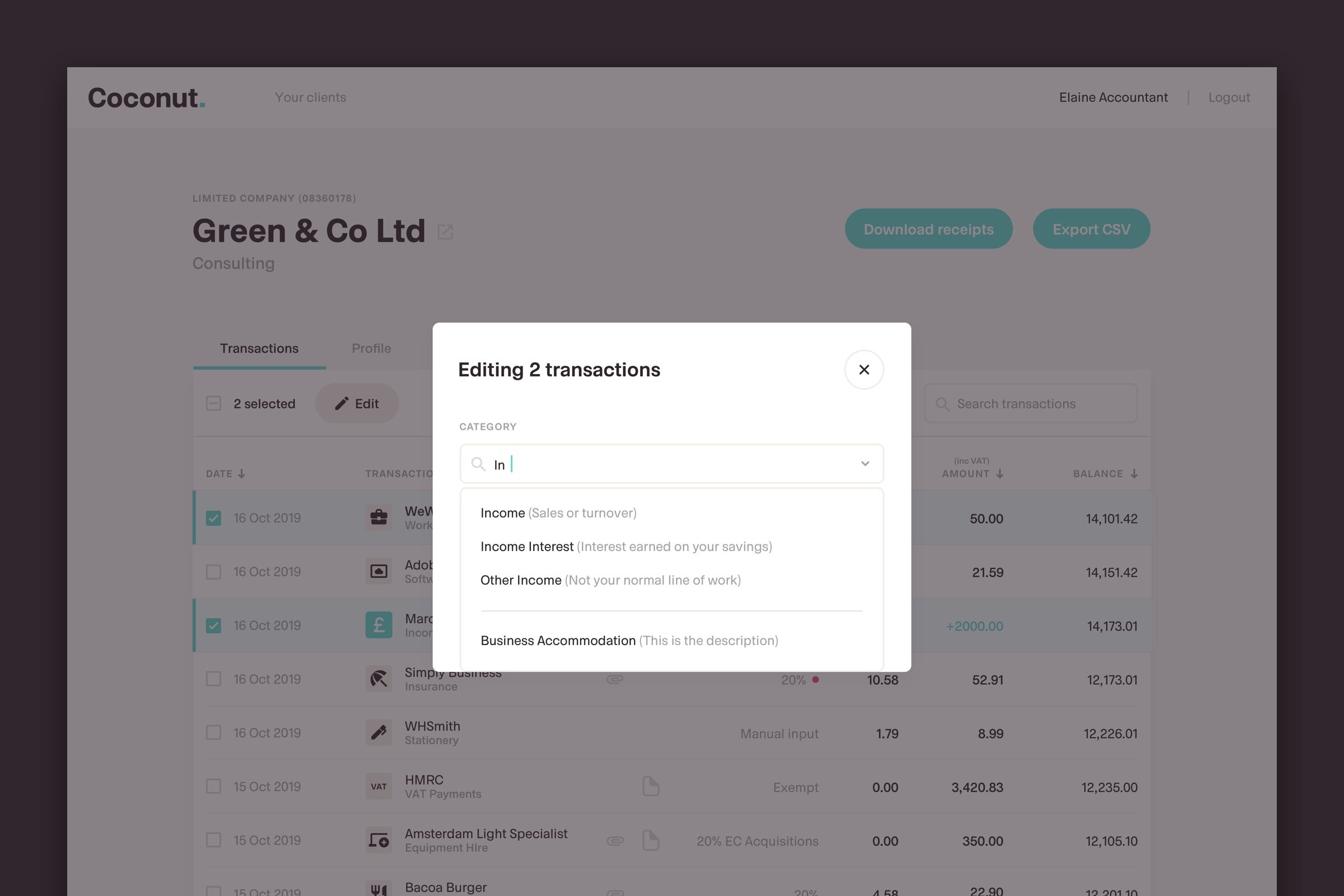

Accountants can see their client's transactions in real-time including the category and VAT rate, as well as view any receipts or notes that have been added. If corrections are needed they can change the category and VAT rate as well as export the data to CSV.

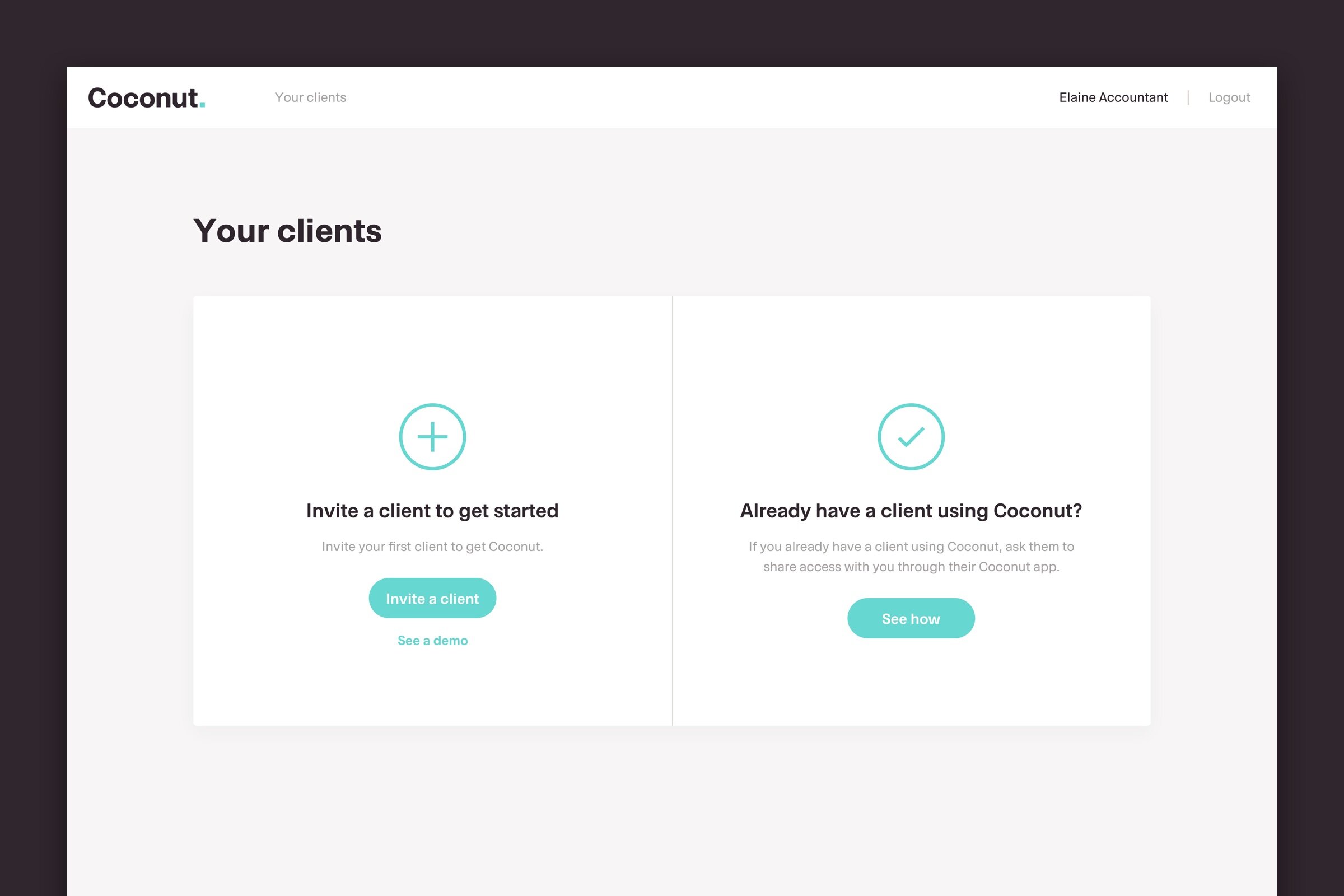

Existing Coconut customers can invite their accountants to the portal or accountants can invite their clients to open a Coconut account.